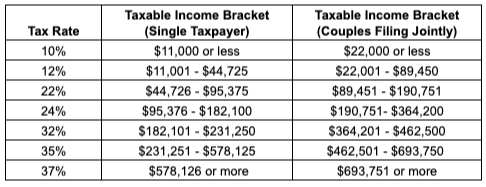

Tax Brackets For 2024 Single Person – Your tax bill is largely determined by tax brackets. How do they work? . There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. .

Tax Brackets For 2024 Single Person

Source : www.forbes.com

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

2024 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Source : taxfoundation.org

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

New IRS tax brackets take effect in 2024, meaning your paycheck

Source : www.fox13news.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

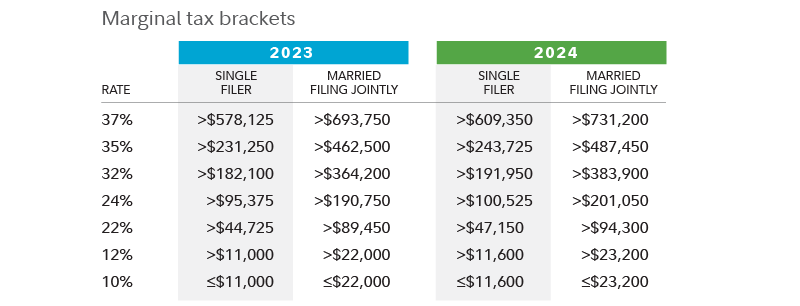

Tax Brackets For 2024 Single Person Your First Look At 2024 Tax Rates: Projected Brackets, Standard : Your tax bill is largely determined by at Colleges and Companies Came Under Siege A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. . According to Fox Business, tax brackets have shifted higher by 5.4% in 2024 for both single and joint filers. Standard decisions also took effect at the beginning of January which will .